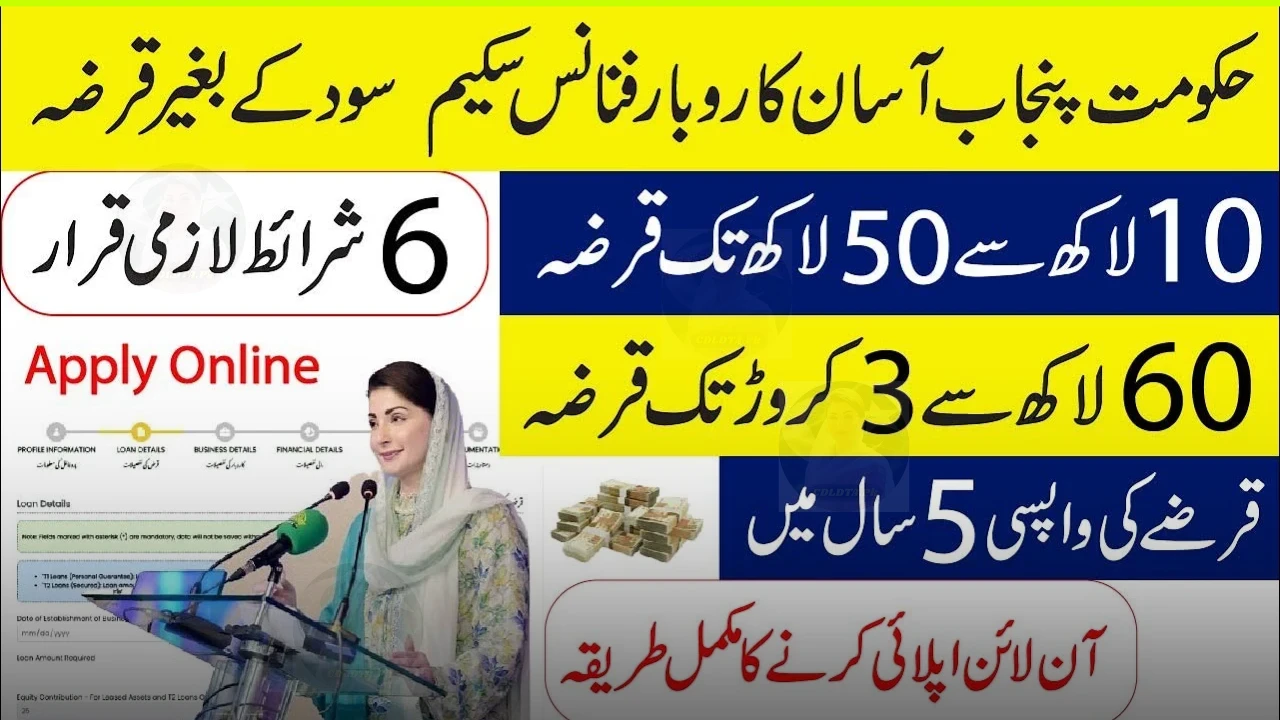

The Asaan Karobar Scheme 2026 is a government loan program in Pakistan designed to support small businesses, startups, freelancers, and unemployed individuals who want to start or expand their business. This initiative provides financial assistance without complicated procedures, helping citizens with strong business ideas but limited capital.

📌 Key Highlights of Asaan Karobar Scheme 2026

| Feature | Details |

|---|---|

| Scheme Name | Asaan Karobar Scheme 2026 |

| Loan Type | Small Business Loan |

| Application Method | Online |

| CNIC Requirement | Mandatory |

| Age Limit | 18 to 60 years |

| Target Group | Small businesses, startups, freelancers |

| Application Fee | Free |

| Loan Usage | Business purposes only |

✅ What is the Asaan Karobar Scheme 2026?

The Asaan Karobar Scheme is a government-backed small business loan program aimed at promoting entrepreneurship and self-employment. By offering financial support to people with strong business ideas, the scheme helps reduce unemployment and strengthen Pakistan’s economy.

Main Objectives:

-

Support small businesses and startups in Pakistan

-

Encourage entrepreneurship and financial independence

-

Reduce unemployment among youth and self-employed individuals

-

Promote sustainable small-scale economic growth

👤 Who Can Apply for Asaan Karobar Loan 2026?

The scheme is designed to make eligibility simple and accessible. Eligible applicants include:

-

Pakistani citizens with a valid CNIC

-

Small shop owners and traders

-

New entrepreneurs and startups

-

Freelancers and self-employed individuals

-

Unemployed individuals with a viable business plan

Basic Requirements:

-

Age between 18 and 60 years

-

Active and valid CNIC

-

No major default on government loans

-

Preference for low to middle-income applicants

💰 Loan Amount and Usage

The loan amount depends on the applicant’s business type, plan, and feasibility assessment.

Approved Uses:

-

Starting a small business

-

Expanding an existing setup

-

Buying machinery, tools, or inventory

-

Managing working capital

⚠️ Loans cannot be used for personal or non-business purposes.

Loan Verification & Monitoring:

| Category | Description |

|---|---|

| Loan Purpose | Business-related activities |

| Personal Use | Not allowed |

| Business Plan | Required |

| Verification Type | CNIC & business review |

| Field Visit | Possible by authorities |

| Bank Account | Mandatory for loan disbursement |

| Approval Basis | Eligibility & document verification |

| Monitoring | Authorities may check loan usage |

🖥 How to Apply Online for Asaan Karobar Scheme 2026

The online application is simple and accessible via mobile or computer. Follow these steps:

-

Visit the official portal: https://akf.punjab.gov.pk

-

Register using your CNIC and mobile number

-

Log in to your account

-

Enter personal and business details

-

Upload required documents

-

Review information carefully

-

Submit the application

-

Save the reference number for tracking

-

Receive a confirmation message after submission

📄 Required Documents for Application

Ensure all documents are complete and accurate:

-

Valid CNIC (front & back)

-

Proof of residence

-

Basic business plan or details

-

Bank account information

-

Mobile number registered in CNIC name

Verification may include phone contact or field visit by authorities.

💡 Tips to Improve Loan Approval Chances

-

Provide honest and accurate information

-

Upload clear and correct documents

-

Keep your CNIC active and updated

-

Prepare a simple, realistic business plan

-

Apply only through official government portal

-

Avoid paying fees to agents or middlemen

🏁 Conclusion

The Asaan Karobar Scheme 2026 is a valuable opportunity for anyone in Pakistan seeking small business financing. With a free online application, simple eligibility criteria, and government support, this scheme helps individuals move toward financial stability and self-employment.

Apply now and take the first step toward growing your business with official government support.

❓ FAQs

Q1: Who can apply for Asaan Karobar Scheme 2026?

Any Pakistani citizen with a valid CNIC who wants to start or expand a small business.

Q2: Is the application process online?

Yes, the Asaan Karobar Scheme 2026 application is fully digital.

Q3: Is there an application fee?

No, the application is completely free.

Q4: How long does loan approval take?

Approval usually takes a few weeks after verification of documents and business plan.